The Daily Ten – Elon Musk’s “Boring Company,” Korean’s buying up U.S. real estate, AI-powered PropTech on the rise…

The Daily Ten

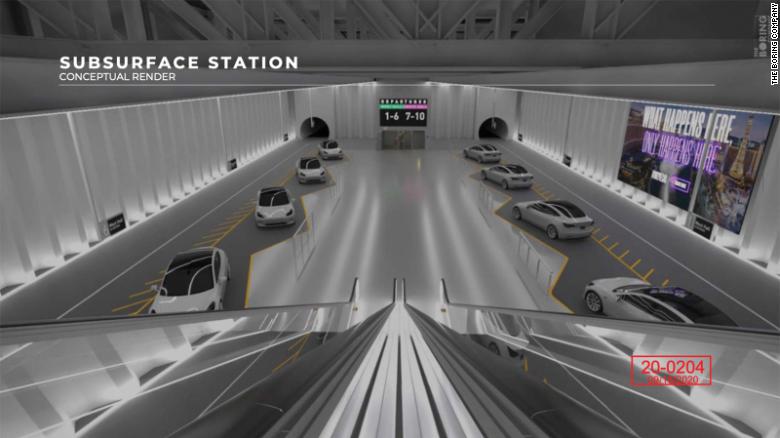

1. Here’s what ‘stations’ for Elon Musk’s The Boring Company look like | CNN Business

Washington, DC (CNN) The Boring Company’s project in Las Vegas was supposed to be the first real demonstration of Elon Musk’s vision for re-imagining public transportation in cities. Musk, who has criticized traditional public transit such as subways, contended he could do much better. He tweeted out visions in 2018 of glass pods, picking up relaxed passengers from thousands of stations the size of single parking spaces that blend into cities, and said it would look “a bit” like that. While more images are still to come, so far the rendered reality is turning out wildly differently.

Transportation experts say that images of Musk’s system that were released last week reflect failures to surmount basic issues that subways solved long ago. They caution that the design for his stations accommodating multiple vehicles appears to show significant drawbacks, such as inefficient use of space and what appears to be a level of inaccessibility for the disabled. However, they note that every detail of a project isn’t necessarily going to be included in a rendering, so it may not show the full scope of the project. More renderings are likely to surface as The Boring Company goes through more city reviews.

“These feel like the kind of renderings an architecture student would do for their one-semester project,” Christof Spieler, a lecturer at Rice University who researches transit and urban planning, told CNN Business. “I don’t see any evidence that this has really been thought through in terms of how it would function.”

2. Korean Appetite for U.S. Commercial Real Estate Heats Up During Pandemic | WSJ

The country’s pension funds, life insurers and other investors have been targeting warehouses and office buildings with long-term tenants

South Korean investors are emerging as some of the most-aggressive buyers of U.S. commercial real estate during the Covid-19 period.

The East Asian country’s pension funds, life insurers and other investors have been targeting warehouses and office buildings with long-term tenants. They are also drawn by ultralow U.S. interest rates, which make currency hedging cheaper.

South…

3. Hover raises $60 million to streamline home inspections with computer vision | Venture Beat

Hover, a startup developing AI-powered apps that create 3D models of homes from smartphone photos, today raised $60 million. The 200-employee company says the proceeds will be used to deepen existing relationships with insurance carriers as Hover expands its product offerings.

In 2017, 6.26% of insured homes experienced a claim, compared to just 4.87% in 2014. Usually, homeowners need to be present at the time of the interior home inspection, and inspections can take between 30 and 90 minutes depending a home and the size of the property.

4. Spacemaker, AI software for urban development, is acquired by Autodesk for $240M | TechCrunch

Autodesk, the U.S. publicly listed software and services company that targets engineering and design industries, has acquired Norway’s Spacemaker, a startup that has developed AI-supported software for urban development.

The price of the acquisition is $240 million in a mostly all-cash deal. Spacemaker’s VC backers include European firms Atomico and Northzone, which co-led the company’s $25 million Series A round in 2019. Other investors on the cap table include Nordic real estate innovator NREP, Nordic property developer OBOS, U.K. real estate technology fund Round Hill Ventures and Norway’s Construct Venture.

Founded by Håvard Haukeland, Carl Christensen and Anders Kvale, and based in Oslo, Norway — but with a number of other outposts around the globe — the 115-person Spacemaker team develops and sells cloud-based software that utilises AI to help architects, urban designers and real estate developers make more informed design decisions. By having Spacemaker look over a designer’s shoulder, as CEO Haukeland likes to say, the software aims to augment the work of humans and not only speed up the urban development design and planning process but also improve outcomes, including around sustainability and quality of life for the people who will ultimately live in the resulting spaces.

5. Serbia is a new, unlikely oasis for NYC residents fleeing the city | New York Post

An unlikely oasis has emerged for travel-starved New Yorkers who crave a change of scene: Serbia.

“It reminds me of Williamsburg circa 2010,” said expat Davis Richardson, 27, who was looking to escape NYC a few months ago and wound up putting roots down in the capital city, Belgrade.

“I now pay half what I paid in New York during a pandemic to live out of a suite overlooking all of Belgrade. It’s a no-brainer: Either I pay double and live with more restrictions, or I pay half for more amenities and experiences with amazing people who want to go out to restaurants and talk about things other than politics,” said the communications specialist.

Richardson meets up with friends for coffee, goes out to nightclubs and hookah bars, and even hits the gun range while living out of a boutique hotel called Mama Belgrade.

“The Serbian mindset is very proud,” he said. “They don’t see a virus as getting in the way of their success and happiness.”

With no quarantine requirement for Americans, the formerly war-torn Balkan country’s hip Belgrade has been a big draw during the coronavirus pandemic. Air Serbia announced 34 flights to JFK in October, far surpassing the 24 routes from October 2019, even in a plagued year for traveling.

6. As Occupancy Dwindles, College Dorms Go Beyond Students | The New York Times

Real estate developers are seeking opportunities to buy student housing from strapped universities and convert them into apartments for white-collar workers.

Yeshiva University was in trouble, and Pebb Capital saw an opportunity.

The financial woes for Yeshiva, the oldest Jewish university in the United States, started in the early naughts, and by 2015, its endowment had shrunk by $90 million. To free up cash, the school began selling pieces of its real estate, including the Alabama, a student housing property in Manhattan that served students at Yeshiva’s Cardozo Law School.

Pebb Capital and its partner, TriArch Real Estate, bought the building for $58 million in 2016, blowing out interior walls and gut-renovating it to convert it from a dated dormitory into sleek, furnished apartments. The investors nearly doubled their money, selling the building for $104 million in February 2020; it now houses a mix of graduate students and young professionals.

“It’s not just students who want this sort of product,” said James Jago, Pebb’s managing director. Demand for inexpensive housing options is rising among those new to the work force.

Pebb wasn’t the only real estate firm to make such a realization. Other investors are jumping in, seeking opportunities to acquire dorms from struggling universities and convert them into housing for white-collar workers.

Thirty percent of American universities, both public and private, are running deficits, according to Moody’s Investors Service, and the pandemic has only added to financial pressures — virtual learning has put campuses into deep freeze, with online classes slashing the population of students who would have otherwise patronized campus bookstores, coffee shops and sporting events.

“It is absolutely a perfect storm,” said Michael Jerbich, president of B. Riley Real Estate Solutions.

“The only thing they can do is turn to real estate or other hard assets.”

7. Americans’ mortgage debt soars to a record $10 trillion | CNN Business

New York (CNN Business)Low interest rates have helped fuel a boom in the US housing market: Last quarter Americans’ mortgage debt climbed to a record high of nearly $10 trillion, the Federal Reserve Bank of New York reported Tuesday.

Homebuyers are leveraging the near-constant new lows in rates. At the beginning of this month mortgage rates fell to a record low — the 12th record low in 2020.

So it’s no surprise that Americans are out buying houses. Between July and September, mortgage debt increased by $85 billion to a total of $9.86 trillion, a record high, according to the report. Mortgages are the largest contributor to household debt in the United States.

The New York Fed’s report was full of records or near-records.

8. BlackRock-Backed Arrival in Talks to Go Public Via SPAC | Bloomberg

Arrival Ltd., a maker of electric vans and buses backed by investors including BlackRock Inc., is in talks to combine with CIIG Merger Corp., a blank-check firm, according to people with knowledge of the matter.

CIIG, a special purpose acquisition company, is in discussions with investors about raising $400 million to $500 million in new equity to support a transaction for the startup, said some of the people, who asked not to be identified because the matter is private. The enterprise value of the combined company is set to be $5 billion to $6 billion, one of the people said.

Terms could change, and as with any deal that hasn’t been finalized, talks could collapse. A representative for Arrival didn’t immediately respond to an email seeking comment, and CIIG declined to comment.

9. Giraffe360, a robotic camera for real estate, raises $4.5M from LAUNCHub and Hoxton Ventures | TechCrunch

Giraffe360 has a robotic camera, combined with a subscription service, which enables real estate agents and brokers to generate high-resolution photos of properties, floor plans and virtual tours. It has now raised $4.5 million in a funding round led by LAUNCHub Ventures and Hoxton Ventures. Also participating is HCVC (Hardware Club), alongside existing investor Change Ventures.

The startup is leaning into the opportunity of 2020 as property viewings have migrated from physical to virtual, in large part because of the pandemic.

Giraffe360 uses a high-specification sensor, lidar laser technology and robotics. The camera is sold to real estate agents and brokers as a service for £399 per month. It was founded in 2016 in Riga, Latvia by two brothers, Mikus Opelts and Madars Opelts, and is headquartered in London, U.K.

10. Savvy Investors Snap Up Centuries-Old Singapore Shophouses | Bloomberg

With their terracotta roof tiles, French-style timber windows and brightly-colored facades, Singapore’s distinctive shophouses are becoming the latest sought-after property asset for family offices, tycoons and real estate funds.

Dating to the 18th century, the two-to-three story buildings have fetched up toS$40 million ($30 million) this year, with the per-square foot price surging as much as 40%, according to Knight Frank LLP. After Singapore lifted its two-month lockdown in mid-June, shophouse deals rose to S$175.1 million in the third quarter from S$117 million the previous quarter, according Savills Plc.

With just 6,500 remaining, the rarity and heritage value of shophouses also appeal to investors. They provide higher rental yields and capital growth than residential property, and can be converted to offices, restaurants, boutique hotels and even high-end co-living spaces.