The Daily Ten – Bitcoin reaches new high, Hong Kong targets yacht parties, Return to the Office fades…

The Daily Ten

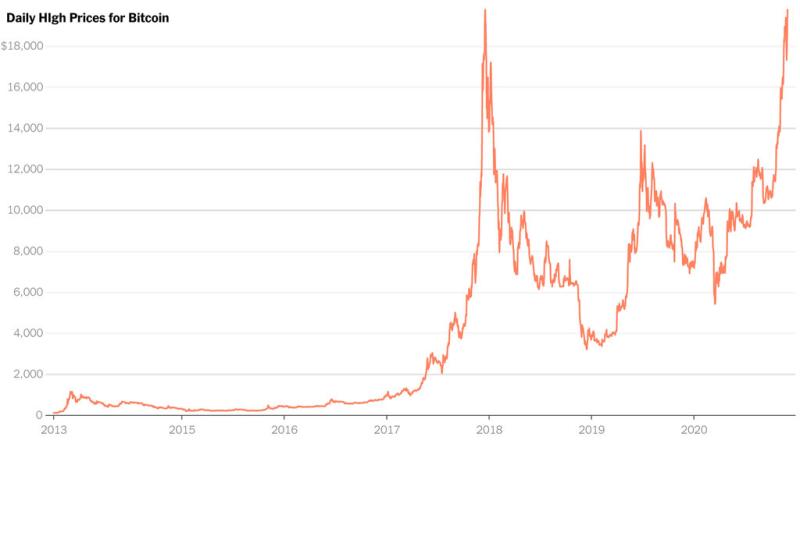

1. Bitcoin Hits New Record, This Time With Less Talk of a Bubble | The New York Times

The crazy cousin of traditional currencies, which fell below $4,000 in March, passed $19,783. More investors now are buying it for the long term.

Bitcoin is back. Again.

Nearly three years after it went on a hair-bending rise and hit a peak of $19,783, the price of a single Bitcoin rose above that for the first time on Monday, according to the data and news provider CoinDesk. The cryptocurrency has soared since March, after sinking below $4,000 at the outset of the coronavirus pandemic.

Bitcoin’s latest climb is different from its last spike in 2017, which was driven largely by investors in Asia who had just learned about cryptocurrencies. Back then, the digital token soon lost momentum as people questioned what it could do other than allow for easy online speculating and drug and ransom payments.

While those questions remain, Bitcoin is now being fueled by a less speculative fever. Buyers — led by American investors, including companies and other traditional investors — are treating Bitcoin as an alternative asset, somewhat like gold, according to an analysis from the data firm Chainalysis. Rather than quickly trading in and out of it, more investors are using Bitcoin as a place to park part of their investment portfolios outside the influence of governments and the traditional financial system, Chainalysis and other industry firms said.

2. A New Setback for Big Cities as Return to the Office Fades | WSJ

The low level of employees back at their workplaces is intensifying pain for cities geared toward office life

U.S. employees started heading back to the office in greater numbers after Labor Day but that pace is stalling now, delivering another blow to economic-recovery hopes in many cities.

The recent surge in Covid-19 cases across the country has led to an uptick in Americans resuming work at home after some momentum had been building for returning to the workplace, property analysts said. Floor after floor of empty office space is a source of great frustration for landlords and companies, which have invested millions of dollars…

3. Guggenheim Fund Files to Be Able to Invest Up to Almost $500M in Bitcoin Through GBTC | CoinDesk

Guggenheim Funds Trust filed an amendment with the U.S. Securities and Exchange Commission to allow its $5 billion Macro Opportunities Fund gain exposure to bitcoin by investing up to 10% of the fund’s net asset value in the Grayscale Bitcoin Trust (GBTC).

4. Aurora Solar raises $50 million to streamline solar installation with predictive algorithms | Venture Beat

San Francisco-based Aurora Solar, which taps a combination of lidar sensor data, computer-assisted design, and computer vision to streamline solar panel installations, today announced a $50 million raise. The company says it will leverage the funds to accelerate hiring across all teams and ramp up development of new features and services for solar installers and solar sales consultants.

Despite recent setbacks, solar remains a bright spot in the still-emerging renewable energy sector. In the U.S., the solar market is projected to top $22.9 billion by 2025, driven by falling materials costs and growing interest in offsite and rooftop installations. Moreover, in China — the world’s leading installer of solar panels and the largest producer of photovoltaic power — 1.84% of the total electricity generated in the country two years ago came from solar.

5. Infogrid raises $15.5M from Northzone to retrofit buildings with ‘smart’ IoT | TechCrunch

Infogrid, an IoT startup which can retrofit an existing building to make it “smart”, has raised $15.5 million. The Series A funding round was led by Northzone, with participation from JLL Spark, Concrete VC, The Venture Collective, Jigsaw VC, an unnamed real estate investment group and an unnamed large international asset owner, although one report speculated that it is Starwood Capital, the property-focused investor.

Infogrid’s platform combines IoT sensors with proprietary AI analysis and has had some success re-vamping facilities management (FM) for some of the world’s largest FM providers, such as global banks, supermarkets, restaurant chains and the NHS. Infogrid also has an “impact-style” mission to enable businesses to reduce the environmental and social cost of their buildings while simultaneously benefitting their bottom line and asset values.

6. Oyo has $1 billion to fund operations until IPO, CEO Ritesh Agarwal tells employees | Mint

Ritesh Agarwal, founder and chief executive officer of Oyo Hotels, told employees the Indian startup is making progress in recovering from the coronavirus fallout and has about $1 billion to fund operations until an initial public offering.

The 27-year-old entrepreneur made the comments in a fireside chat with Oyo board member Troy Alstead, after the once high-flying company endured months of layoffs and losses as Covid-19 hammered its business. Oyo is one of the largest startups in the portfolio of SoftBank Group Corp., reaching a valuation of $10 billion before the downturn.

Agarwal said the company’s focus is on getting revenue per available room to 60% to 80% of pre-pandemic levels across all markets. India, China, Japan and Southeast Asia are making progress in reaching that range, he added.

7. Nikola plunges after GM drops $2 billion stake in electric truck maker | New York Post

Shares of Nikola plunged nearly 25 percent after General Motors scrapped plans to buy a stake in the electric truck manufacturer and produce its Badger pickup truck.

A new, slimmed-down deal maintains the companies’ fuel technology partnership but jettisons key components of a tie-up that thrust Nikola into the spotlight in September — just two days before a short-seller leveled sweeping fraud allegations against the firm and its founder, Trevor Milton.

“This went from a game changer deal for Nikola to a good supply partnership but nothing to write home about,” Wedbush Securities analyst Daniel Ives said.

The news sent Nikola’s stock price plummeting nearly 25 percent to a low of $21 a share in early trading Monday.

8. Reinventing Workers for the Post-Covid Economy | The New York Times

Especially in service industries, old jobs may not be coming back. Training programs are aiming to provide skills for more resilient occupations.

Rob Siminoski has been in the theater, in one way or another, since he graduated from college. But after 10 years at the Universal Studios theme park in California, he is only No. 13 on the stage-managing roster. Even if the park, closed since March, reopens some attractions — the WaterWorld stunt show, say, or the Nighttime Lights at Hogwarts Castle — he is unlikely to be among the first to get the call.

His luck is that his union, the International Brotherhood of Electrical Workers, offers an apprenticeship program for on-set movie electricians. It takes five years, and Mr. Siminoski, 33, is going to have to brush up his high school algebra to get in. Still, it offers a good balance of risk and reward.

“Everyone needs electricity,” he said. “You pull down six figures.”

The nation’s economic recovery from the Covid-19 pandemic will hinge to some extent on how quickly show managers can become electricians, whether taxi drivers can become plumbers, and how many cooks can manage software for a bank.

9. Zoom Video Communications Obliterates Quarterly Earnings Estimates | Deadline

Zoom Video Communications, perhaps the ultimate corporate poster child of Covid-19, posted another blockbuster quarter of financial results.

The videoconferencing specialist said its profit in the quarter ending October 31 came in at 99 cents a share, well ahead of Wall Street analysts’ consensus expectation for 76 cents. Revenue more than quadrupled to $777.2 million, far better than analysts’ forecast for $694 million.

Shares in Zoom finished the trading day at $478.36, up more than 1%, but then fell back 5% after the earnings results were released. The stock has rocketed more than 600% in 2020 as the company’s technology has become a bedrock of the pandemic operating environment for companies, schools and institutions of every stripe.

10. Hong Kong Targets Yacht Parties in Latest Virus Crackdown | Bloomberg

Hong Kong has set up a hotline for residents to report parties aboard yachts and rented party boats, as the financial hub tightens social-distancing rules to contain a surge of virus cases.

With nightclubs and karaoke parlors closing as a result of a new round of restrictions, some people were hosting rule-breaking gatherings at sea, Chief Executive Carrie Lam told a weekly news briefing Tuesday ahead of a meeting of her advisory Executive Council. Holding parties aboard rented “junks” in Hong Kong’s iconic harbor and off outlying islands is a favorite weekend pastime.