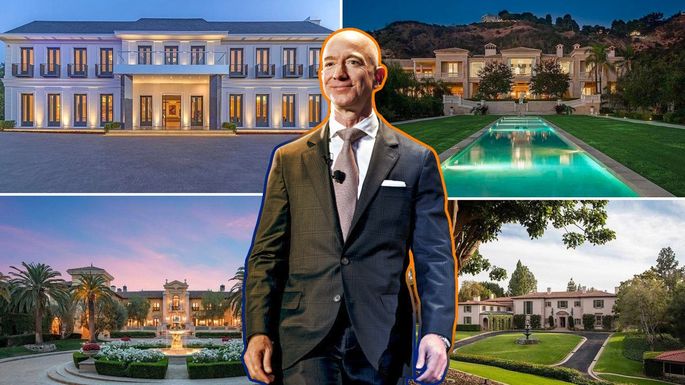

Jeff Bezos Is Shopping for a $100M-Plus L.A. Home: Which One Will He Pick?

Is Jeff Bezos looking to make another land grab on the West Coast? According to the New York Post, the Amazon.com titan, who already owns two properties in Beverly Hills, is apparently poking around Los Angeles for another mansion to add to his California collection.

And since money is no object, billionaire Bezos and his girlfriend, Lauren Sanchez, have reportedly been touring the priciest mansions—the ones over $100 million—in Beverly Hills and Bel Air, some of the Los Angeles area’s toniest enclaves.

This Week in Real Estate Innovation

PROPTECH CORNER

Europe’s A/O PropTech is a new €250M fund dedicated to companies disrupting real estate | TechCrunch

A/O PropTech is a new European VC officially launching today, after raising €250 million of so-called “permanent capital” to invest in technology companies disrupting real estate.

It’s this “permanent” approach—seeing the firm structured more like a corporate with various shareholders, rather than a traditional venture capital fund that typically has a life cycle of 2-5 years—which allows A/O PropTech to be stage agnostic. The VC invests from Series A to later growth stages and claims to be more patient with regards to the timing of any exit.

ARTIFICIAL INTELLIGENCE & ROBOTICS

Construction startup Scaled Robotics raises a €2M seed round | TechCrunch

Industrial robots are expensive. But, then, so are construction mistakes. Being off by an inch here or there adds up quickly, and too often crews need to correct costly errors.

There’s a reason construction has become the next great target of the robotics and automation industries, with a number of startups vying to create solutions that can constantly monitor sites to detect mistakes before it’s too late.

TechCrunch’s Disrupt Berlin Battlefield winner Scaled Robotics this week is among the early-stage startups tackling the problem. This morning, the small Barcelona-based construction startup announced that it has raised a €2 million seed investment, led by European firms Norwegian Construct Venture and PropTech Fund Surplus. The funding follows a €1 million pre-seed.

Tropical Breezes, Pristine Beaches and a Domain Name to Die For | NY Times

The luxury resorts along serene white-sand beaches have long propped up the economy of Anguilla, a tiny British territory in the Caribbean.

But the island is also the lucky financial beneficiary of two hot trends in technology: artificial intelligence and vanity internet addresses.

Anguilla is the landlord for internet addresses that end in “.ai” — a suddenly valuable slice of online real estate. Every time a .ai name is registered or renewed — by A.I. start-ups, or by speculators hoping to resell the names to those start-ups, big companies or investors — the island collects a $50-a-year fee, which goes mostly to the government treasury.

Cherre Raises $16M for Real Estate Data Analytics Platform | BuiltinNYC

Cherre, a real estate data and analytics company, announced Wednesday it closed on $16 million in growth funding in a round led by Intel Capital. Modeled after high frequency trading tools, Cherre’s SaaS platform leverages AI to help insurance companies, banks and investors instantly collect, augment and analyze datasets from hundreds of thousands of sources. This enables these customers to make smarter decisions about potential investment and underwriting opportunities.

THE FUTURE OF WORK

New York-based coworking provider Coalition Space was evicted from its branch at 68 Harrison Ave. in Boston’s Chinatown neighborhood Jan. 14 after not paying rent in November and December, according to court records. The coworking company, through a dedicated special purpose entity it set up for the space, had paid less rent than it owed for 14 months prior to that, lawyers for landlord Mai Luo claimed in a Boston Municipal Court filing late last year.

OPPORTUNITY ZONES

The grandson of legendary investor and billionaire Warren Buffett is getting into Opportunity Zones, but in an unusual way.

Howard W. Buffett is rolling out a software tool that measures an Opportunity Zone investment’s potential social, environmental and economic impact. Through his advisory firm, Global Impact, Buffett developed the software, “Impact Rate of Return,” with financial technology company NES Financial.

WHAT’S NEW IN BLOCKCHAIN?

The government of Australia has today released a national blockchain roadmap to help drive the adoption of the technology in the country.

The 52-page roadmap, issued by the government’s Department of Industry, has noted that blockchain has the potential to create jobs, save companies money and improve Australia’s economic growth.

Recently the University of Oxford published a paper on digital assets and real estate. Entitled, “Tokenization: the Future of Real Estate Investment?“, the document believes there is potential in tokenizing the popular asset class but also sees certain challenges. For example, tokenization of property as an investment will not take place overnight. Additionally, using blockchain technology to tokenize funds may be a more advantageous approach going forward than single assets, according to the authors.

THE VENETIAN, LAS VEGAS | SEPT 8 – 11, 2020 | ANYSIZEDEALSWEEK.COM

AnySizeDeals Week Update

Come showcase your innovative real estate solution at The Venetian Resort in Las Vegas, during AnySizeDeals Week – The Festival of Real Estate Innovation.