Buffett Missed Out on Crisis, Revealing Berkshire’s Big Weakness

Below are some interesting articles covering real estate innovation this week.

There are only 2 Days! left to APPLY to the early stage PropTech startup competition ASDCup – Where PropTech is Discovered!. The semifinalists are invited to pitch live at The Venetian Resort in Las Vegas as part of AnySizeDeals Week – The Festival of Real Estate Innovation, September 8 – 11, 2020.

This Week in Real Estate Innovation

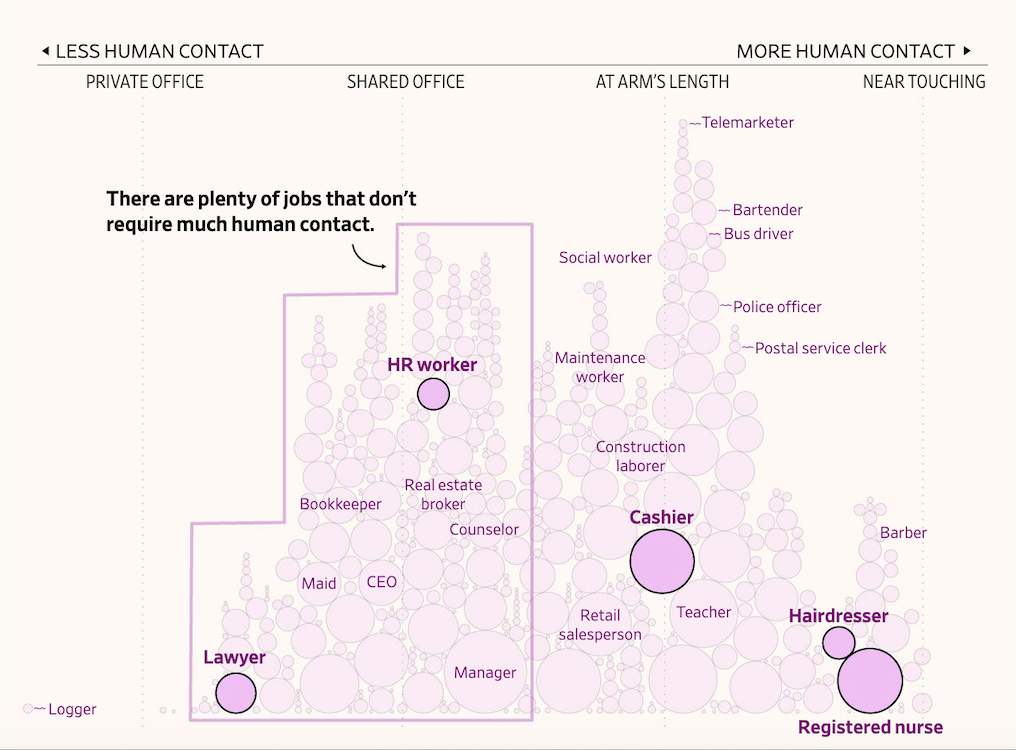

THE FUTURE OF WORK & THE WORKPLACE

Under 25 and Working? Social Distancing Might Not Be Possible | WSJ

In early April, Erin Payne drove to the group home in southwest Ohio where she cares for two men with serious disabilities. Normally, the 21-year-old would blare country music to keep her awake on her 40-minute commute. That day, she drove in silence.

“I was absolutely terrified,” she said.

She was returning to her position as a home health aide after six weeks of maternity leave, during which the coronavirus outbreak turned into a pandemic. Soon, she would be waking up her clients, dressing them, brushing their teeth, shaving them, and making their breakfast. Maintaining six feet, or even six inches, of distance would be impossible

BLOCKCHAIN NEWS

Blockchain: UK Investment Firm London Chelsea Limited to Offer London Digital Bonds Backed by Real Estate | Crowdfund Insider

London Chelsea Limited says it has partnered with SolidBlock to offer a digital asset fund that invests in real estate.

According to a release, London Chelsea Limited will sell a “London Digital Bond” described as a digital security backed by property. London Chelsea is a firm that advises on the buying and selling of residential investment properties in London and the Home Counties…

ARTIFICIAL INTELLIGENCE & ROBOTICS

Elementary Robotics raises $12.7 million to automate industrial inspections | Venture Beat

Elementary Robotics, a robotics company developing tools to automate industrial tasks, today announced it has raised a $12.7 million round. The fresh capital will be used to deploy the Los Angeles-based startup’s automation products at scale, a spokesperson told VentureBeat…

Refraction AI’s robots start delivering groceries in Ann Arbor | Venture Beat

Refraction AI, a company developing semi-autonomous delivery robots, today began handling select customers’ orders from Ann Arbor, Michigan’s Produce Station. This marks the startup’s first foray into grocery delivery after the launch of its restaurant delivery service. The move comes as Refraction reports a 3-4 times uptick in pandemic-related demand…

STATE OF THE MARKET

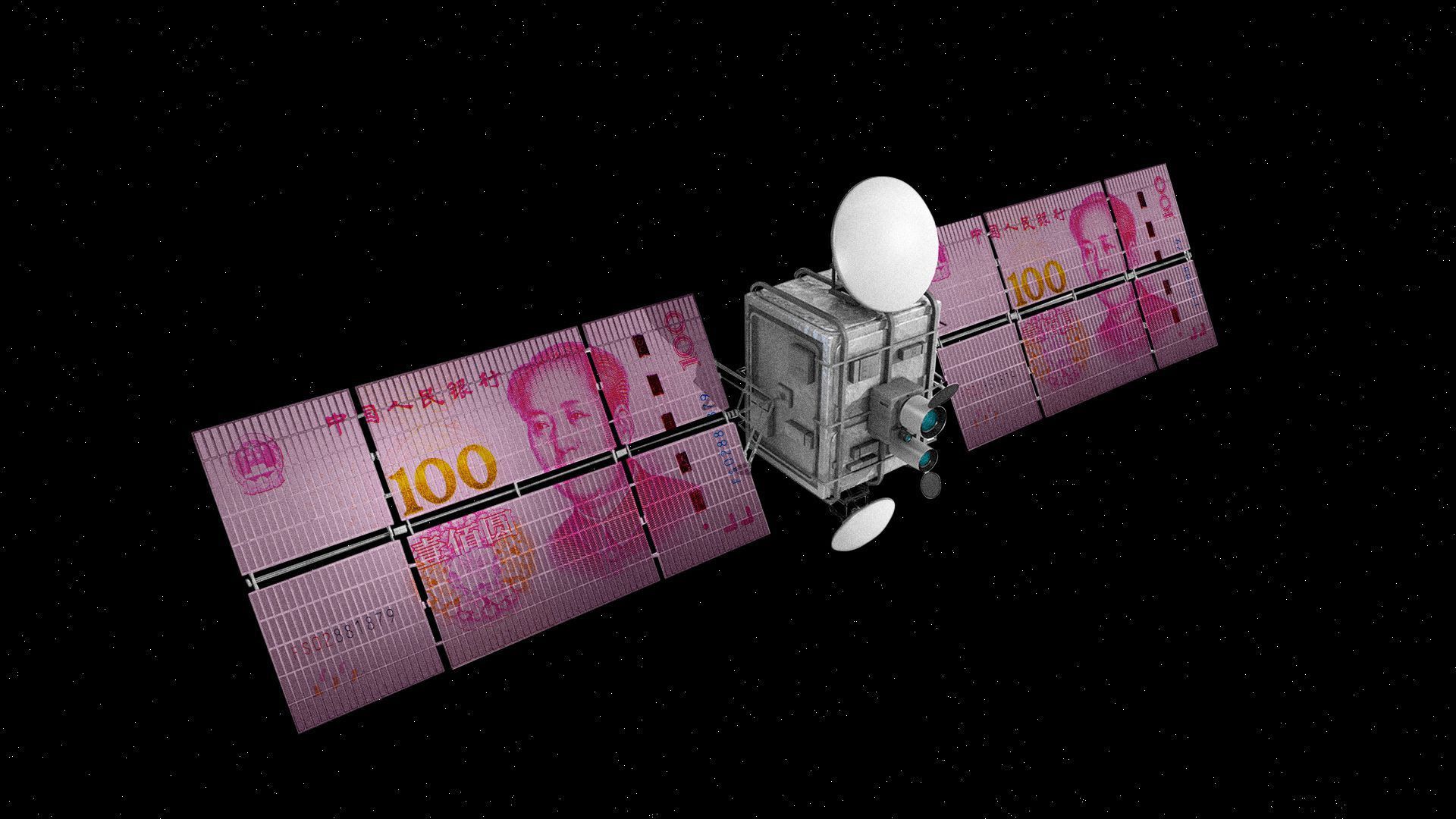

China’s commercial space industry charges ahead | Axios

China’s commercial space ambitions stretch far beyond the industry’s current domestic focus, with plans to use private space capabilities to help bring Chinese influence to the world.

Why it matters: Space is a cornerstone of the global race for tech supremacy, and China wants to dominate from both a governmental and commercial standpoint…

Buffett Missed Out on Crisis, Revealing Berkshire’s Big Weakness | Bloomberg

Warren Buffett has likened it to a forest, laid out its building blocks, and even tried to break it down into different groups to explain the setup. But his Berkshire Hathaway Inc. has always defied neat categorization.

Constructed from the remains of a New England textile company, Berkshire is a mashup of businesses from the railroad BNSF to auto insurer Geico to Dairy Queen to party goods supplier Oriental Trading. It also holds a portfolio of substantial investments in public companies such as Apple Inc. and Wells Fargo & Co…

Erie Opportunity Zones to Receive $40 Million Investment from New Partnership | Erie News Now

A massive capital investment will infuse $40 million into Erie Opportunity Zones (OZ) that will help transform downtown Erie into an inclusive space where people will want to work, live, eat and play.

Erie Insurance and The Erie Community Foundation (ECF) are partnering with Arctaris Impact Investors, LLC, a Boston-based national impact investor, to enable the investments in Erie.

The new program will be called Arctaris Erie.

Officials say most of the money will be invested in Erie Downtown Development Corporation (EDDC) shovel-ready projects and the rest in other mission related investments (MRI) within Erie County Opportunity Zones…

PROPTECH CORNER

Axeleo Capital launches new VC fund ‘Axeleo Proptech 1’ with the goal to invest €50 million in European proptech startups | EU-Startups

Axeleo Capital today announced the initial closing of its acceleration fund “Axeleo Proptech 1”. This new investment vehicle aims to reach €50 million and has already completed an initial round of €35 million syndicated with the Banque des Territoires, on behalf of the French State, international corporates and financial institutions (RTE, Vinci Energies, Allianz France, Groupe VYV), the Île-de-France Region and European family offices…

Proptech start-up closes Series A round | Financial Review

Proptech start-up Before You Bid has signed off on a Series A funding round, backed by one of the original team members behind $7 billion registry services giant Computershare.

Street Talk understands mortgage broking outfit Square 1 Group – owned by ex-Computershare finance controller Tony Wales – and high net worth New Zealanders the Gillespie family, were the major investors in the funding round.

Construction startup Katerra lays off 400+ employees | The Real Deal

SoftBank-backed construction startup Katerra has laid off more than 400 employees, one month after new CEO Paal Kibsgaard stepped into the top job.

The cuts amount to 7 percent of the company’s total headcount, according to the Information. The staff affected worked in departments including human resources and civil engineering and mechanical engineering, the publication reported.