A Multibillion-Dollar Opportunity: Virus-Proofing the New Office

Below are some of the cool articles covering real estate innovation this week. Also please remember to let your network know the deadline to apply to ASDCup – Where PropTech is Discovered! is July 3rd, 2020.

This Week in Real Estate Innovation

THE FUTURE OF WORK & THE WORKPLACE

A Multibillion-Dollar Opportunity: Virus-Proofing the New Office | NY TIMES

Tech, catering and design companies are rushing to sell employers on fever scanners, box lunches and office floor-planning apps for social distancing. But it’s too soon to tell if they will work.

Truework, an income verification start-up, recently introduced software to help employers keep track of their workers’ health status.

Gensler, an architecture and design firm, has a workplace floor-planning app that generates social-distancing layouts for desks and other office furniture.

PwC, the professional services firm, is using technology that it originally developed to track inventory for a new contact-tracing system that logs employee interactions so workers can be notified in the event of exposure to the coronavirus…

Librestream raises $24 million to automate field technician tasks with AI | Venture Beat

As COVID-19 cases spread across the globe, Librestream popped up to keep medical professionals safe with its Onsight remote streaming software and Onsight Cube thermal camera that can be added to wearables for remote patient temperature screening. Today, the company announced a $24 million funding round to expand Onsight’s footprint while using AI to improve its capabilities…

BLOCKCHAIN NEWS

Binance China Blockchain Institute Partners with NYSE Listed Xinyuan Group to Develop Real Estate Services | Crowdfund Insider

Binance China Blockchain Institute, the research institute of crypto exchange Binance, has announced a partnership with Xinyuan Group (NYSE:XIN), a Chinese real estate company working on incorporating blockchain technology in the global real estate industry including in New York City. Xinyuan Group previously launched “UPRETS,” a real estate digitalization platform for fractional real estate investments…

ARTIFICIAL INTELLIGENCE & ROBOTICS

AI Manufacturing Startup Drishti Raises $25 Million To Go Global With Its Factory Floor Analytics | Forbes

Try to think of the top manufacturing startups today, and you might struggle to name one. While some companies leverage manufacturing to achieve futuristic ideas such as redesigning living organisms or colonizing Mars, few have turned their attention to the heart of the process: factory floors. “Manufacturing is the most unsexy space for anybody to be in,” admits Prasad Akella. “It takes deep conviction on the investors’ part to want to put money in this space. Silicon Valley has walked away from manufacturing for the last 20 to 25 years.”…

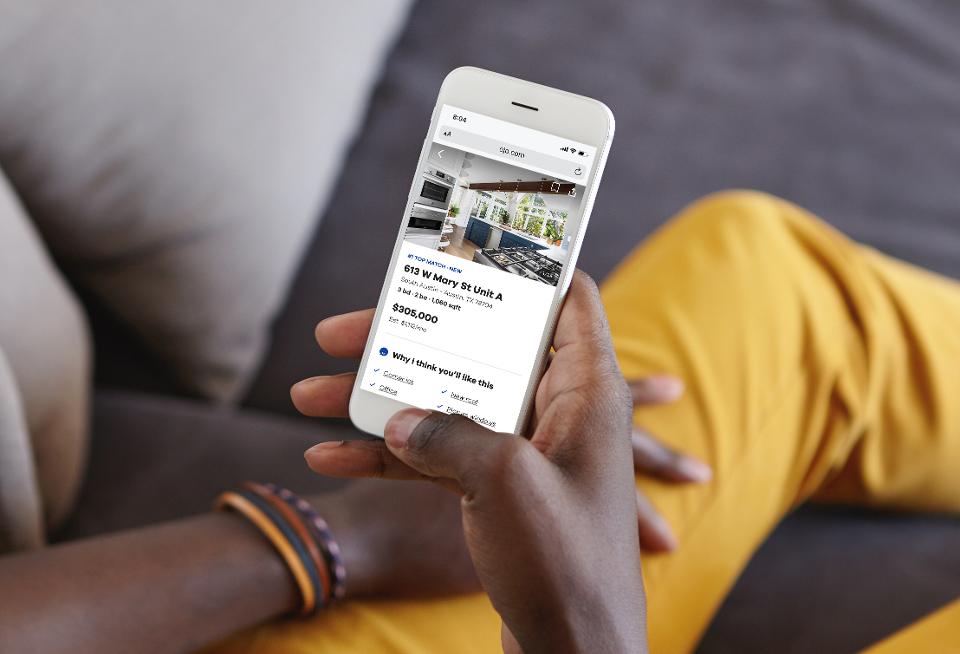

Artificial Intelligence Real Estate Firm OJO Labs Raises $62.5 Million, Buys Home Listing Site | Forbes

Having closed a fourth round of funding, OJO Labs, a real estate company that deploys artificial intelligence to the home buying experience, announced today the acquisition of home listing website Movoto.

Austin, Texas-based OJO Labs, known for its proprietary personal assistant technology that blends machine learning and human operations, raised $62.5 million in a Series D financing round, led by investment firm Wafra. Other investors include Breyer Capital, LiveOak Venture Partners, Royal Bank of Canada, and Northwestern Mutual Future Ventures.

STATE OF THE MARKET

Plexiglass to the Rescue: Supplies Run Short as Covid Barriers Go Up | WSJ

ROME—Stefano Antonelli has sculpted plexiglass for decades in his workshop, making bikes and furnishings and works of art. But a recent customer request stood out. A local hospital asked for a box to cover patients’ heads, a barrier to prevent transmission of the coronavirus.

It was one of many pleas for protective equipment made of the transparent acrylic that the 58-year-old artisan has received over the past months from stores, restaurants and professionals…

Europe Lease Deals Suggest Traditional Office Will Endure in Post-Covid World | WSJ

Big U.S. companies such as Twitter Inc. and Facebook Inc. say they are embracing working from home and looking to reduce office space. But across the Atlantic, the traditional office market is showing signs of life.

Europeans are certainly leasing less office space overall, with demand tumbling 21% in the first three months of 2020 from the five-year average, according to Savills PLC. Coronavirus lockdowns put crucial site viewings and property inspections on hold, and some companies are relying more on video technology to…

Property Owner Simon Sees Buying Tenants as a Way to Boost Malls | WSJ

Simon Property Group Inc. is digging into its wallet to rescue another big tenant, a move that could help stabilize its mall business but one that raises new questions about the industry’s longer-term viability, analysts say.

The biggest mall owner in the U.S. by number of malls is teaming up with Brookfield Property Partners, another large owner of shopping centers, in exploring a bid for J.C. Penney Co., according to a person familiar with the matter. The department-store chain filed for bankruptcy in May…

…

PROPTECH CORNER

PropTech consolidation as Yabonza expands | Financial Review

Fast-growing proptech disrupter Yabonza has made its first acquisition since being founded three years ago by former Macquarie executives.

The digitally focused property management platform, which heavily undercuts the fees charged by traditional agents, has acquired fellow disrupter Easyshare, a rental and bills payment app for share houses…

Hospitality Startup Sonder Raises $170 Million At A $1.3 Billion Valuation During Covid-19 Travel Collapse | Forbes

Sonder appears to have broken out of the hospitality slump. As Covid-19 has pushed traditional hotel occupancy rates below 20%, shrunk airline demand by 95%, and all-but obliterated business travel—the short-term apartment rental company has closed a $170 million Series E round.

Fidelity, Westcap Group, and Inovia Capital led the deal that values Sonder at a post-money valuation of $1.3 billion—a slight up-tick from its Series D round last July. “It’s pretty extraordinary given the situation,” says Cofounder and CEO Francis Davidson, who appeared in the 2018 Forbes Under 30 list…